Outline the main causes of unemployment in Australia and discuss its impact on the economy

Unemployment is the situation where individuals want to work, however, are unable to find a job. Many causes disable Australians from seeing and being accepted for adequate work, in addition to the many impacts on the individual people and the economy. The effect of the downturn in the business cycle, in addition to the ever-changing industries, causes a reduction in economic growth, an increase in government spending, lowers inflation, and causes poverty. Despite the reduction in inflation, unemployment reduces economic growth and decreases the living standards in Australia.

There are many causes of unemployment in Australia, however it is most often a result of cyclical or structural unemployment that hinder an individual’s ability to find a job based on their skills or the current economic situation. The effect of cyclical unemployment in Australia was shown in March of 2020 when the underemployment rate hit a historic high of 13.8 percent, with 1.8 million people having significantly reduced work or being no longer employed due to economic reasons (One year of COVID-19, 2022). The recession during the pandemic in 2020 clearly demonstrates the dependence of the unemployment rate on the economic upturns and downturns.

Often cyclical turns into structural unemployment, as seen in the 2008 financial crisis. The younger generation of under 55 on average were unemployed for 19.9 weeks, this is compared to the 44.6 week average of unemployment that 55- 65 yr olds experienced, in addition to many deciding to retire early due to the lack of work (Harder to Find a Job, 2022). Structural unemployment affected the older workers as they were more likely to be skilled in industries that were replaced by new technology and were less likely to retrain to find a job of equal pay. Cyclical and structural unemployment is the leading cause of the negative and positive effects of unemployment on the economy.

Unemployment decreases the number of goods and services produced in an economy, thus decreasing economic growth and negatively affecting the economy, according to the Federal Reserve Bank of St.

Louis,“Output (economic growth) depends on the amount of labor used in the production process (the employment rate)” (Yi Wen, 2012). This relationship is seen in figure 1 – “UK unemployment and economic growth” (RBS, 2022), where there is an inverse relationship between unemployment and economic

growth. This theory is proven by Okun’s law which states that there is a positive relationship between economic growth and employment. Therefore, when the unemployment rate is high, economic growth is low, often leading to a downturn in the business cycle (Okun’s Law, 2022). According to Okun’s law, if there is a 1% increase in unemployment, it would cause a2% fall in GDP. Similarly, another version of Okun’s law states that a 1% fall in unemployment will cause a 3% rise in gross national product (Yi Wen, 2012). Both versions of okun’s law depict the importance of having a fuller workforce in order to increase economic growth. Unemployment, therefore, has a negative impact on the economy via economic growth and changes in the GDP.

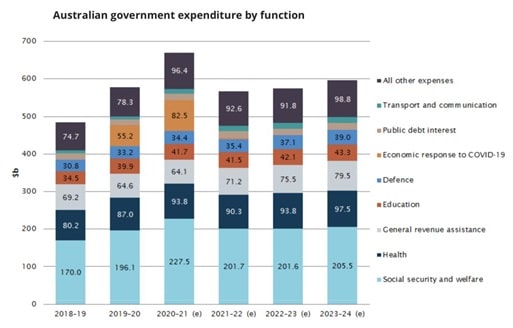

In addition to reducing economic growth, high unemployment costs the government a high amount of welfare payments in order to support people to afford necessities. As seen in figure 2 – “ Australian government expenditure by function” (Australian Government expenditure, 2022), the spending on welfare in Australia increased by $31.4B from2019/2020 to 2020/21 (Australian Government expenditure, 2022), following the unemployment rate increase of 2.3% . Similarly, as the unemployment rate decreased to 3.8% from the peak of 7.4% (Labour Force, Australia, 2022), the government spending was reduced by $25.8B. This trend of unemployment causing an increase in welfare spending by the government highlights the impact of unemployment on the government. Welfare and social security expenditure in the 2020–21 budget is $227.5 billion, representing 33.9 per cent of the Australian Government’s total expenditure (Social security and welfare, 2022).

This significant amount spent on welfare emphasises the importance of keeping unemployment low, in order to spend less on welfare payments for those who are unemployed. Keeping welfare payments to a minimum would allow an increase in government spending elsewhere, in addition to a reduction of tax in Australia. Unemployment has a negative effect on the economy by causing the government to pay a significant amount more to help those in need than with a lower unemployment rate.

On the other hand, a high employment rate often leads to a high inflation rate, which is the rate that measures the price increase over time, causing a fall in the purchasing value of money (What Is Inflation?, 2022). Figure 3 – “US Unemployment – Inflation” (Pettinger, 2022) depicts this as there is an inverse relationship between unemployment and inflation.

The relationship shows the positive effects of unemployment on the economy, due to a reduction of likelihood of going into a recession, due to high inflation (Why is inflation so high, 2022). The causation is reiterated with the 1991 recession in Australia; following the recession, the unemployment rate reached 10.9% (Unemployment rate, 2022), the highest it had been in over 10 years. Following the high unemployment, inflation reached a low point of 0.97% (Statista, 2022).

Despite having an uncommonly low inflation rate, it is closer to the ideal inflation of just under 2% (FRB, 2022) than the current inflation rate of 5.1% (Consumer Price Index, 2022). This means thatin order to achieve an ideal inflation rate, the unemployment rate must be above 6%. Although high employment can cause short term increased economic growth and reduced government welfare spending, it can cause an economy to slow down or go into recession.

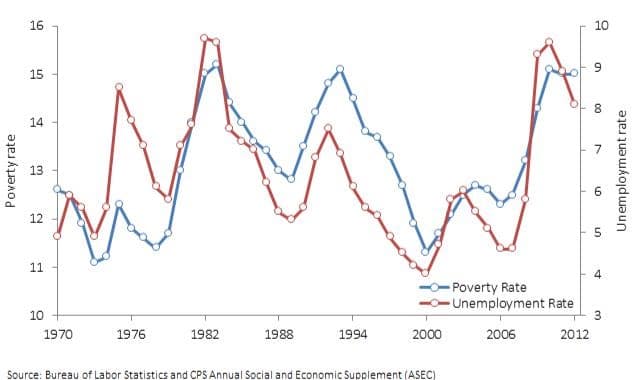

In addition to the economic impacts, unemployment impacts individuals often through poverty, where people can’t afford the basic necessities. The effect of unemployment on the poverty rate is clearly demonstrated in figure 3 – “Unemployment vs. poverty rate” (Emily Cuddy, 2022). The trend of high poverty for high unemployment is clearly demonstrated, as unemployment leads people to not afford basic necessities, thus described as living below the poverty line.

The impact of unemployment on the poverty rate was demonstrated during the COVID-19 pandemic; in 2019 when the unemployment rate was 5.16% (Act on poverty, 2020), while the poverty rate in Australia was 10.5%. This rate increased to 13.2% in 2020 as the unemployment rate increased to 7.4% (Labour Force, Australia, 2022). The high poverty rate, in addition to affecting the individual people, negatively affects the economy in a similar way to unemployment, making it detrimental to not only an economy, but a society as a whole.

Overall, cyclical and structural unemployment have both positive and negative effects on the economy, citizens and consumers. Despite the control of inflation that unemployment supplies, it slows down economic growth, costs billions of dollars for welfare and significantly impacts those who are unemployed.

References:

Antipovertyweek.org.au. 2022. [online] Available at: <https://antipovertyweek.org.au/wp-content/uploads/2019/07/Poverty-in-Australia-APW-2019.pdf> [Accessed 28 May 2022].

Files.stlouisfed.org. 2022. [online] Available at: <https://files.stlouisfed.org/files/htdocs/publications/es/12/ES_2012-06-08.pdf> [Accessed 26 May 2022].

Indexmundi.com. 2022. Australia Unemployment rate – Economy. [online] Available at: <https://www.indexmundi.com/australia/unemployment_rate.html> [Accessed 27 May 2022].

Aph.gov.au. 2022. Australian Government expenditure. [online] Available at: <https://www.aph.gov.au/About_Parliament/Parliamentary_Departments/Parliamentary_Libra ry/pubs/rp/BudgetReview202021/AustralianGovernmentExpenditure> [Accessed 26 May 2022].

Statista. 2022. Australian inflation rate 2027 | Statista. [online] Available at: <https://www.statista.com/statistics/271845/inflation-rate-in-australia/> [Accessed 25 May 2022].

Australian Bureau of Statistics. 2022. Consumer Price Index, Australia, March 2022. [online] Available at: <https://www.abs.gov.au/statistics/economy/price-indexes-and-inflation/consumer-price-inde x-australia/latest-release> [Accessed 26 May 2022].

Emily Cuddy, a., 2022. Poverty: It’s More than a Job Market Story. [online] Brookings. Available at: <https://www.brookings.edu/blog/social-mobility-memos/2014/09/12/poverty-its-more-than-a- job-market-story/> [Accessed 27 May 2022].

Federalreserve.gov. 2022. FRB: What is an acceptable level of inflation?. [online] Available at: <https://www.federalreserve.gov/faqs/5D58E72F066A4DBDA80BBA659C55F774.htm> [Accessed 24 May 2022]. Australian Bureau of Statistics. 2022. Labour Force, Australia, April 2022. [online] Available

at: <https://www.abs.gov.au/statistics/labour/employment-and-unemployment/labour-force-austr

alia/latest-release> [Accessed 25 May 2022]. Australian Bureau of Statistics. 2022. One year of COVID-19: Aussie jobs, business and the economy. [online] Available at:

<https://www.abs.gov.au/articles/one-year-covid-19-aussie-jobs-business-and-economy> [Accessed 30 May 2022]. Pettinger, T., 2022. Trade off between unemployment and inflation – Economics Help. [online]Economics Help. Available at:

<https://www.economicshelp.org/blog/571/unemployment/trade-off-between-unemployment- and-inflation/> [Accessed 27 May 2022]. Business Insider. 2022. RBS: The chance of an imminent recession is 75%. [online]Available at:

<https://www.businessinsider.com/rbs-the-chance-of-an-imminent-recession-is-75-2016-1> [Accessed 26 May 2022].

Aph.gov.au. 2022. Social security and welfare. [online] Available at: <https://www.aph.gov.au/About_Parliament/Parliamentary_Departments/Parliamentary_Libra ry/pubs/rp/BudgetReview202021/SocialSecurityWelfare> [Accessed 23 May 2022].

Investopedia. 2022. Unemployment and Economic Growth: Okun’s Law. [online] Available at: <https://www.investopedia.com/articles/economics/12/okuns-law.asp> [Accessed 23 May 2022].

Investopedia. 2022. What Is Inflation?. [online] Available at: <https://www.investopedia.com/terms/i/inflation.asp> [Accessed 25 May 2022].

The Conversation. 2022. Why is inflation so high? Is it bad? An economist answers 3 questions about soaring consumer prices. [online] Available at:<https://theconversation.com/why-is-inflation-so-high-is-it-bad-an-economist-answers-3-ques tions-about-soaring-consumer-prices-173572> [Accessed 26 May 2022].

The Balance. 2022. Why It’s Harder to Find a Job Now in Some Industries. [online] Available at: <https://www.thebalance.com/structural-unemployment-3306202> [Accessed 19 May 2022].