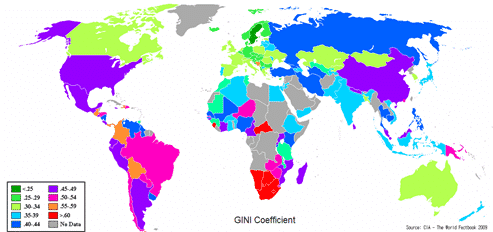

As seen on the graph, the level of inequality (the metric measured by the Gini coefficient) is dispersed in a largely uneven manner across the globe, with the exception of the clear trends seen in the major players, trade blocks.

The entire EU has a very low Gini coefficient, indicating low financial equality throughout. ASEAN members also have a low level of inequality and vary very little in Gini constant throughout. Trade blocks tend to prove highly fruitful for the economies of member countries, allowing their governments to grow wealthy and invest in their people (where corruption is not present).

However, another clear trend are LICS and NEEs experiencing exceptionally high levels of inequality according to the Gini coefficient, as seen in the example of South Africa, a country with a Gini coefficient exceeding 60.

This is due to many transnational corporations choosing to set up operations in LICs and NEEs like South Africa due to low taxes and cheap land and labour in addition to the ability to bypass environmental industry standards.

The Coca Cola Company for example has set up numerous bottling operations in South Africa, for example. Although on initial inspection it might seem as though these countries are benefiting from globalization, it is apparent that these companies give very little back to the residents of these countries, as they are among the most unequal in the world.

It is clear that there is a gaping divide in the inequality of a population around the globe, with the HICs and their trading blocks growing more fair, while the LICs and NEEs are used and abused by globalization, increasing their Gini Coefficient and making them less fair, with wealth staying far out of the hands of the average citizen; this supports the Chomskyan view that globalization is rending the world apart, with the divide between the poor and the rich growing larger. It is likely that this trend will only continue into the future, as trade blocks strangle weaker entities into submission.