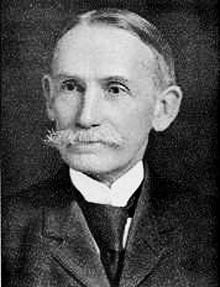

John Bates Clark was an American economist who lived from 1847-1938. He played an important role in the development of marginal productivity, and had a great influence on the development of economic thought in the United States. Clark was educated at Amherst College and at the University of Heidelberg in Germany.

He taught at Carlton College in Northfield, Minnesota from 1875 to 1881. He then moved on to teach at Smith College, Amherst, Johns Hopkins and Columbia from which he retired in 1923.

In formulating the Neoclassical theory of the firm, John Bates Clark took over the classical categories of land, labor, and capital and simplified them in two ways, this simplification was the theory of marginal productivity.

First, he assumed that all labor is homogenous, which meant that one labor hour is a perfect substitute for any other labor hour, but when marginal productivity was decreasing, the industry found it more profitable to replace labor with machinery.

Clark believed that to make a sound economy wages had to be equal to the marginal productivity of labor. This was also beneficial to both the industry and the labor. Secondly, Clark ignored the distinction between land and capital, grouping together both kinds of non-human inputs under the general term “capital,” which he then assumed that the broadened “capital” is homogenous.

John took this Neoclassical approach one step further than others in applying it to the business firm and the maximization of profits. One of the results was a theory of the distribution which demonstrated that market outcomes were just. Clark also believed that technological change would lead to an increase in the standard of living which he felt was one of the chief goals of any economic system.

He felt that with this technological change, labor would be more productive and lead to higher profits for the industry. When the labor would see that industry was making higher profits, they would demand its share of the profits for their hard work. The labor’s higher wages and the industries’ higher profits would increase incomes and better the social living for everyone.

Among Clark’s works are The Philosophy of Wealth (1886), The Distribution of Wealth (1899), and Essentials of Economic Theory (1907). His son, John Maurice Clark, also became a noted economist and even co-wrote some work with his father, but his work is remembered as being quite different from and in some ways even contradictory to, his father’s.

Critics believe that John Bates Clark’s ideas were somewhat incomplete because they showed the ideal economy and not the real world of imperfect markets and factors of production. Clark’s ideas have aided in the explanation of human economic behavior, and many economists today share his views on marginal analysis and the increased standard of living.

In his combination of the land and capital John Bates Clark did a great dis-service to many of the previous economists such as Adam Smith, David Ricardo and Henry George, all of whom took care to distinguish between capital values which is the result of human labor and land values which are not.

The loss of this more analytic position in our knowledge about macroeconomics has set back the development of scientific knowledge in our subject many decades. Although the ideas of George, for a “single tax” based on land values, the political forces and lobbying of land-owning monopolists and speculators in its growing value, has resulted not only in a failure to properly explain how our social system works, but has seriously delayed the way that progress might otherwise have been made in our social system.

By a better sharing of the benefits due to controlled and unlimited land access, with the associated ground-rents being returned as revenues to the national government instead of other means for taxation, there would be a greater opportunity for the proper use of land without the associated corruption and speculation in its value. The cost of producing goods due to the Smithian return on this right of access, would be considerably reduced and the dangers of unemployment, poverty and homelessness of our present social regime would be eliminated were land values taxed instead of incomes, purchases, capital gains etc.